California VA Fees & Costs

The California VA Funding Fee is charged to most borrowers who receive a loan guaranteed by the VA. The exact amount of the fee is determined by the specific status of the Veteran or active-duty person, as well as the terms of the loan (see table below).

Why do I have to pay a fee? A little background:

The VA doesn’t actually lend the money for a California VA Loan, they insure it.

The loan itself is like any other—30 year fixed, etc. When the loan is made however, a VA Funding Fee (some call it a VA Loan Fee) is required from most borrowers and added to the loan (although it may be paid at closing) and collected by the VA. This VA Loan Fee is similar to the premium you would pay on an auto insurance policy to pay for repairs on a car if you get in an accident. But in this case, in the event that you should default (stop paying) on your obligation (the VA Loan), the one being paid (reimbursed) is the lender who fronted the money for the purchase of the home.

With most loans, when you put less than 20% of the purchase price as a down payment, monthly mortgage insurance is required. With a California VA Loan however, you can have a down-payment of less than 20% (actually, a California VA Loan allows $0 as a down payment). Unlike other loans allowing less than a 20% down payment, there is no monthly mortgage insurance on a California VA Loan; only the one-time VA Funding Fee at the beginning of the loan. This makes your monthly payments more affordable on a VA Loan.

It’s because of this VA Funding Fee, or insurance, that lenders are willing to make larger loan amounts with smaller down payments. The VA Funding Fee pays for the insurance.

How much is the California VA Funding Fee?

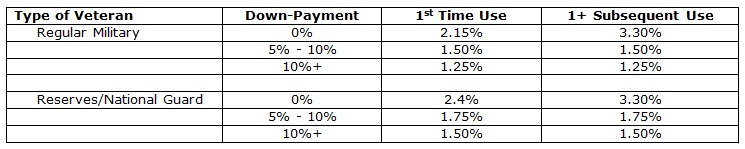

The actual amount of the California VA Funding Fees varies depending on the borrower and the specific loan circumstance: First-time user vs multi-time (subsequent) user; Active-Duty or Veteran vs Reserve; down-payment or no down payment.

Take a look at the California VA Funding Fee Chart below for fees prior to 1/1/2020.

IMPORTANT: Page under construction; contact us for increased fees pursuant to the

Blue Water Navy Vietnam Veterans Act of 2019:

For Purchases*

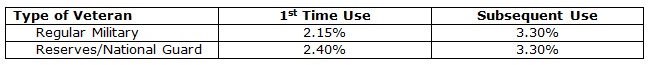

For Cash-Out Refinances

Rate-and-Term Refinance (lowering interest rate only)

(These are called Interest Rate Reduction Refinance Loans (IRRRLs))

- For those who currently have a VA Loan: .50%

Other Circumstances

- Manufactured Home Loans: 1.0%.

- Native American Direct VA Loan: 1.25%

- VA Assumption: .50%

VA funding rates have changed over time, but the rates listed in here are for VA loans that will be closed before September 30, 2016. If you are interested in taking out a VA loan past this date, please feel free to contact us for the current fee amounts.

Calculating the California VA Funding Fees and the final VA Loan amount:

The funding fees is just a percentage of the loan amount. Below is an example of how to calculate the California VA Funding Fee and the final VA Loan amount for a Regular Military, 1st time user putting 5% down on a $350,000 home:

$350,000 - $17,500 (5%) = $332,500 (loan amount). $332,500 X 1.5% = $4,987.50 (actual fee). The final loan amount: $332,500 + $4,987.50 = $337,487.50.

Do I always have to pay the California VA Funding Fees?

There are a few exceptions that allow for the fee to be waived:

- California Veterans who are getting VA compensation due to service related disabilities.

- California Veterans who would be receiving VA compensation due to service related disabilities if they were not already receiving retirement pay.

- Loans for spouses of veterans who passed away in service or because of service-related disabilities.

The Bottom Line:

All things being equal, those who are eligible for a California VA Loan who want to put down less than 20%, will qualify for more home by using a California VA Loan than another type of loan.